How to Use a High-Yield Savings Account as an Emergency Fund

Creating an emergency fund is key to financial stability. Here’s how you can utilize a high-yield emergency fund to help you get there even faster.

Share:

.

An emergency fund is a secure source of cash used for unexpected expenses, such as a car repair, the loss of stable income, or surprise medical bills.

In this article, we’ll walk through the benefits of using a high-yield savings account like Growth Savings to save for unplanned expenses. Then, we provide a few ways to use Growth Savings as your dedicated emergency fund.

Benefits of Using Growth Savings as an Emergency Fund

Because low risk and accessible emergency funds play an important role in personal finances, it’s common practice to park these savings in a high-yield savings account.

- Your funds are protected. Our savings account is housed securely at Forbright Bank, an institution insured by the Federal Deposit Insurance Corporation (FDIC), which protects funds up to the established limits.

- Your earning potential is higher. While saving for the unexpected, it makes sense to earn money on the savings you don’t plan to spend any time soon. By utilizing a high-yield savings account like Growth Savings, you earn a percentage of interest on every dollar in your account.

- Your money is easily accessible. Unlike a CD or retirement plan, you can regularly access your savings online and are able to transfer money from your Growth Savings account into your checking account whenever it’s needed.

- There are no fees or minimum balance requirements. In fact, Forbright Bank charges no account fees for Growth Savings.

Using a high-yield savings account like Forbright Bank’s Growth Savings as a dedicated emergency fund is an easy way to prepare for the future with peace of mind.

Below are some of the best ways you can transform your Growth Savings account into an emergency fund.

Schedule Recurring Transfers

The easiest way to build your emergency fund is by setting up automatic recurring deposits each month into your high-yield savings account. Recurring transfers occur when you schedule money to move automatically from one account to another.

For example, say you teach yoga on the weekends or work as a freelancer in the evenings. You might choose to schedule this extra amount to transfer automatically from your checking to Growth Savings to grow your emergency fund faster.

Or you might choose to schedule a smaller portion of your paycheck to go directly into your Growth Savings account, allowing you to build an emergency fund that grows steadily.

Scheduling recurring transfers in your Growth Savings account is easy. Simply follow these steps:

Step 1: Log in using your Growth Savings username and password.

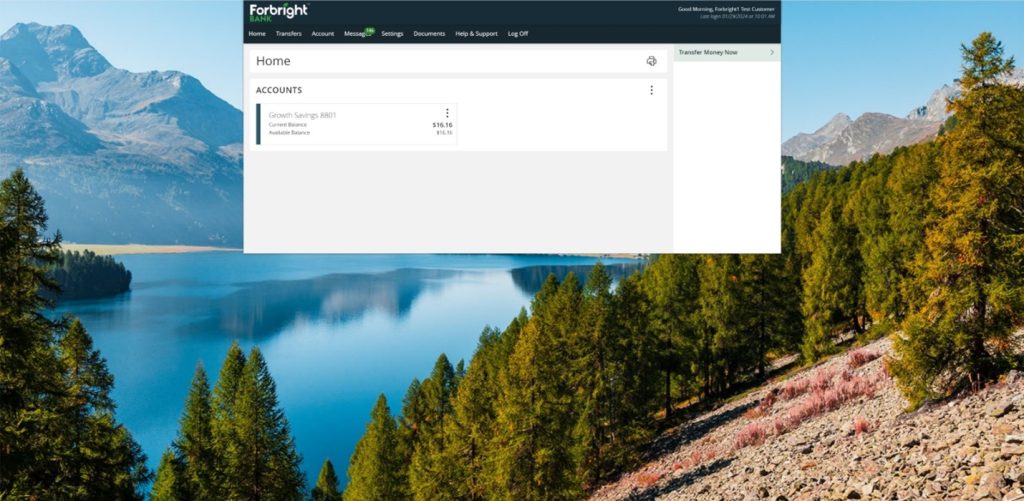

Step 2: There are two ways to navigate to recurring deposits. Either you can (1) click on your Growth Savings account, or (2) click “Transfers” from the navigation bar menu.

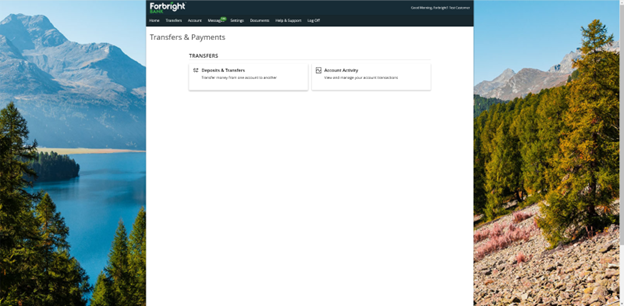

Step 3: Click “Deposits and Transfers.”

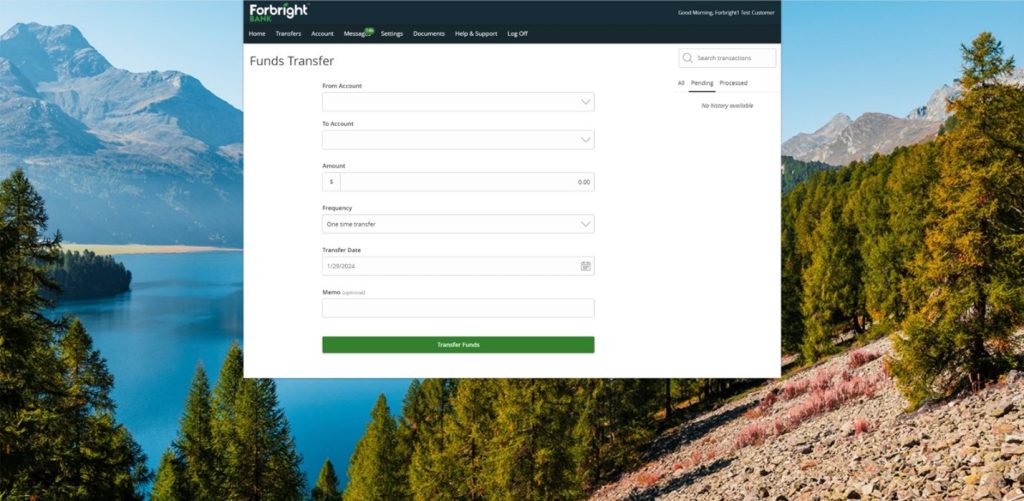

Step 4: Fill in the form using the drop-down menu to choose between accounts.

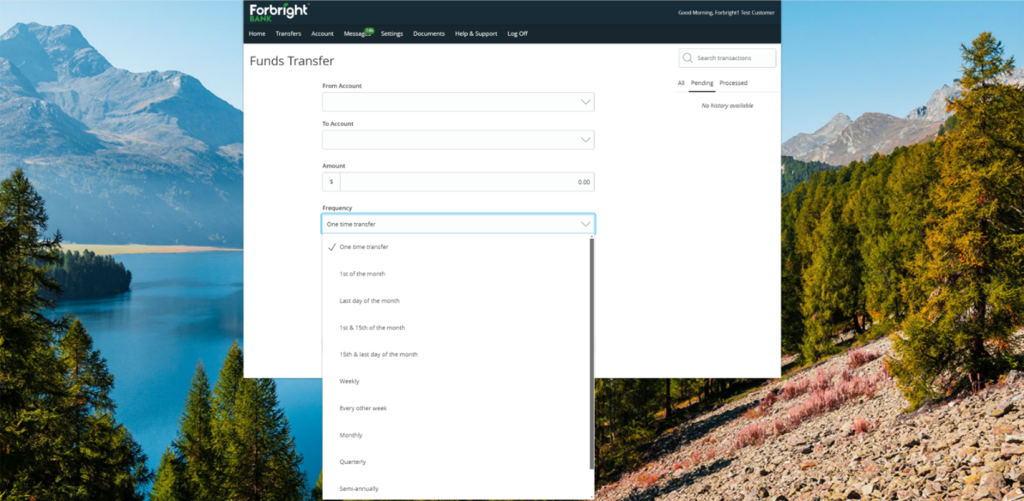

Step 5: Using the drop-down menu, choose your preferred frequency.

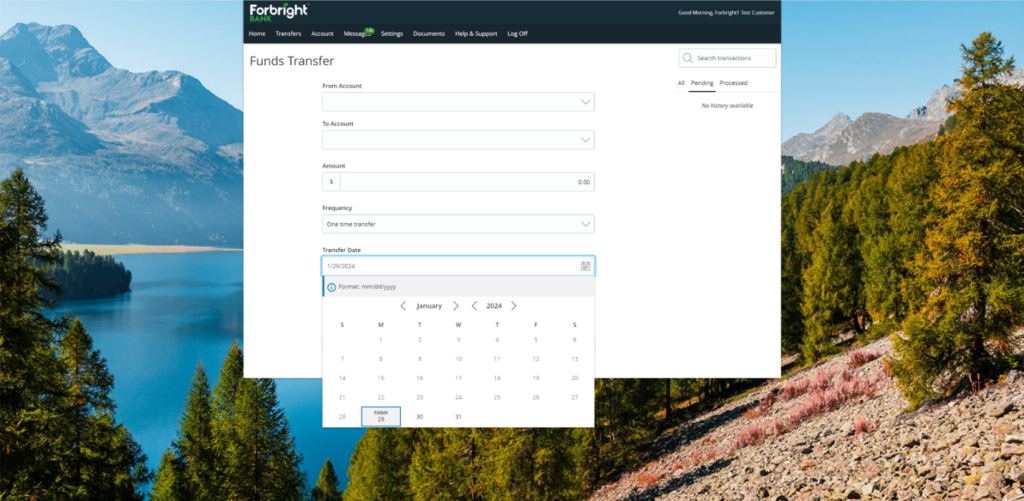

Step 6: Using the calendar, schedule your transfer.

Regardless of how much you’re ready to save today for emergencies that could occur tomorrow, you might be surprised by how much you can build over time with a recurring contribution. And while the exact amount you choose to save depends on your personal circumstances and goals, there are a few more general tips to help guide you in the right direction.

Start with Smaller Transfers

You do not need to start your emergency fund with big transfers to make a big impact. If you know you need an emergency fund but use most of your paycheck to cover day-to-day bills, start saving by considering an important bill you would need to cover in the event of income loss. It could be as small as a cellphone bill or as big as monthly rent.

To help you get started with covering this critical expense, you can open a Growth Savings account with no minimum balance requirement and simply schedule smaller recurring transfers to build up to a larger amount of savings over time.

And since Growth Savings is a high-yield savings account, you will earn interest on every dollar saved, allowing you to meet your emergency savings goal sooner than you would using a traditional, or lower yield, savings account.

Define Your Goal

If you are ready to set aside more money for potential emergencies, it’s helpful to evaluate the living expenses you have today. While many experts recommend building 3 to 6 months’ worth of living expenses, the exact amount you should save in your emergency fund depends on your personal preferences.

To help you determine the amount of money you need to save to cover 3 to 6 months of living expenses, start by calculating the amount of money you would need to cover just one month of:

- Utilities. How much do you spend in a single month on the average energy, sewer, water, cell phone, and internet bill? Total these bills or average them out to see how much you would need to save for one month of utilities.

- Childcare. If childcare is inconsistent, base your calculation on the most expensive scenario. While it might be tempting to ignore this cost – after all, you could watch your kids if you’re out of work – remember that finding another job takes time. Retaining at least some childcare during unemployment can give you time to update your resume, network, apply for positions, and interview.

- Groceries. Consider your total grocery bill for a month’s worth of cooking at home. Depending on how often you eat out or order in, this will probably be a larger amount than your current monthly grocery bill, so plan your scenario accordingly.

- Health insurance and chronic medical care. Monthly health-insurance premiums can run steep, and if your employer covers most of yours, it may be difficult to estimate the exact amount in a jobless scenario. Still, try to imagine a prospective replacement cost – not just for monthly insurance premiums but also recurring care, from prescription medication to mental health.

- Housing costs. Your emergency savings should cover rent or mortgage payments. Make sure to include any extras, such as insurance, adding up to your total monthly housing costs.

- Loan repayments. Falling behind on loan repayments can have long-term consequences, so it’s important to account for any regular loan payments in your emergency scenario. That’s especially true for high-interest loans, such as credit card debt.

- Transportation. Transportation can include monthly car payments and insurance, in addition to gas, parking, and tolls. If you take public transportation, taxis, or rideshares, be sure to include your typical monthly expenditures for those, too.

Work Up to Bigger Transfers

While scheduling smaller recurring monthly contributions is a great way to build an emergency fund, it also may be helpful to save in “sprints ” to help you reach your goals sooner.

For example, occasional cash windfalls, such as birthday gifts, tax returns, and paycheck bonuses, are a useful way to accelerate your emergency savings or level up the money that’s already in there. When you know a gift or big bonus is on the horizon, take advantage of the momentum by designating that month as a month to save. When the “sprint” is over, you could use the interest you earned to celebrate.

Ready to start building your emergency fund and earning interest? Apply today to open your Growth Savings account.

This article is for general information and education only.