Survey Results: Money Confidence in High-Yield Savings Accounts

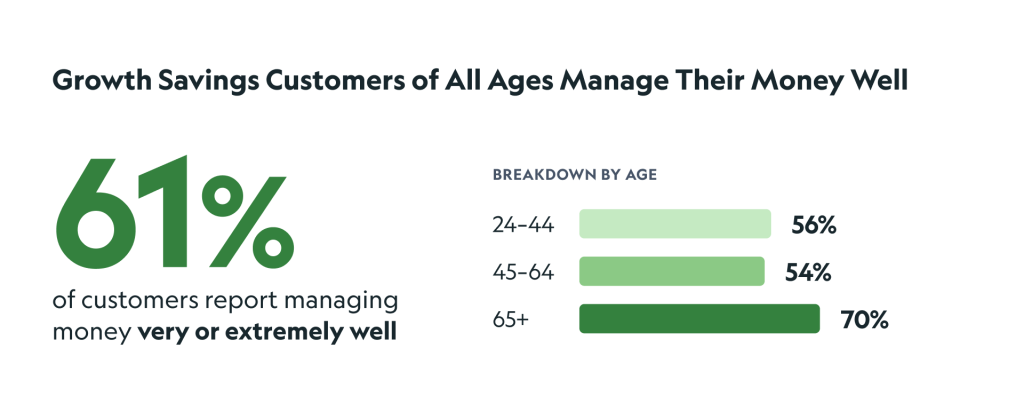

61% of Growth Savings customers say they manage their money well.

Share:

Despite mixed economic news throughout 2025, owners of Growth Savings high-yield savings accounts report a high level of confidence in their money management skills and habits (61% are very or extremely confident).

Other research reports low levels of confidence among the general population; for example, one 2025 survey shows that only 13% of American consumers feel “very good” about their financial situation. According to Forbright Bank’s 2025 survey, Growth Savings customers view their financial situation much more positively than the average consumer. In addition, survey respondents pinpoint the habits, choices, and strategies that have helped them achieve and maintain a high level of financial confidence and wellness.

Money Management and Wellness

Most high-yield savings account owners at Forbright Bank feel confident and optimistic about their money management practices. When asked how well they manage their money, 61% of responding Growth Savings customers said they manage their money very or extremely well.

The positive feelings about personal money management were consistent across generational groups and were especially high for the oldest respondents. For example, 70% of respondents age 65+ said they manage their money well. Even the youngest survey respondents ranked their money management skills highly, with 47% of those ages 18-24 reporting they manage money very or extremely well. Respondents between the ages of 24-44 were slightly more positive than Gen Xers (ages 45-64), from 56% to 54% saying they manage their money well.

Question: How well would you say you manage your money?

What does it mean to manage money well?

We recommend five easy money moves to control your finances and reduce debt.

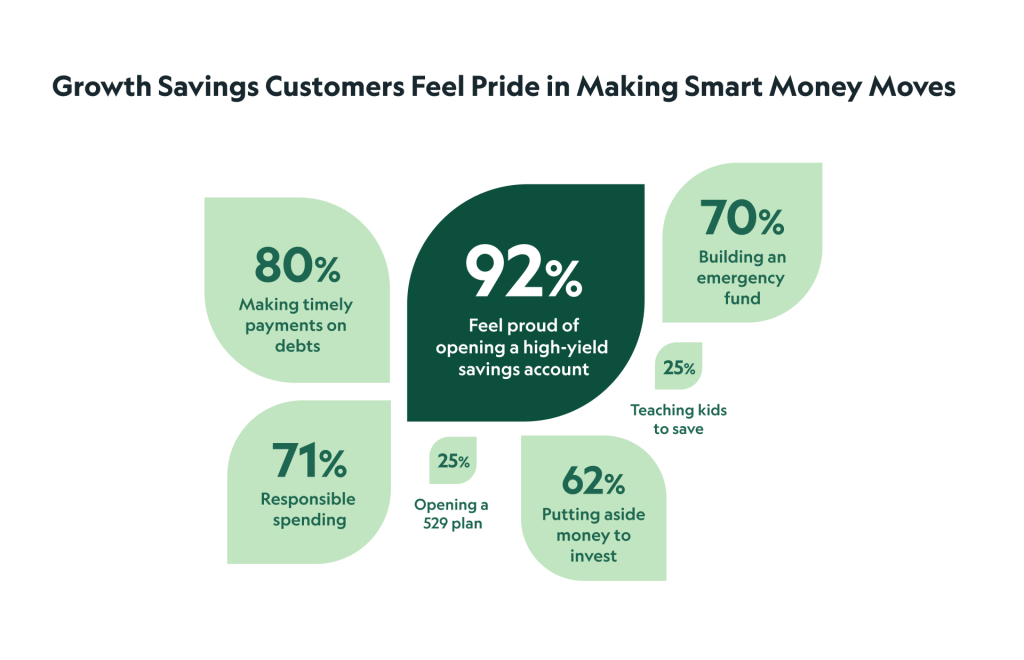

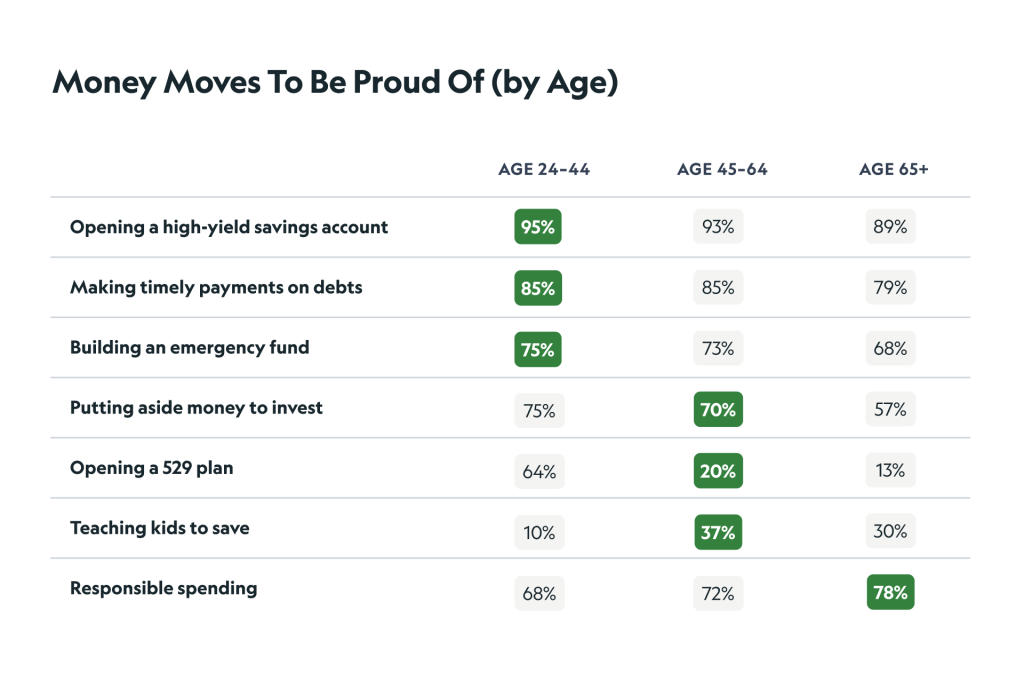

We asked survey respondents to share the actions they have taken that have helped them feel proud of how they manage their money. More than nine in 10 (92%) said opening a high yield savings account made them feel proud of their money management – the highest ranked action people took to feel proud of their financial management. This was followed by making timely payments on debts (80%), responsible spending (71%), and building an emergency fund (70%).

Across all ages of respondents, the most consistent responses were making timely payments on debts and building an emergency fund.

Some respondents provided even more specific details. For example, Sheri H. said she was proud of “never paying interest on credit cards,” and William K. said he’s proud of “spending less than I earn.”

Question: Which of the following, if any, has helped you feel proud of how you manage your money? Select all that apply.

Question: Which of the following, if any, has helped you feel proud of how you manage your money? Select all that apply.

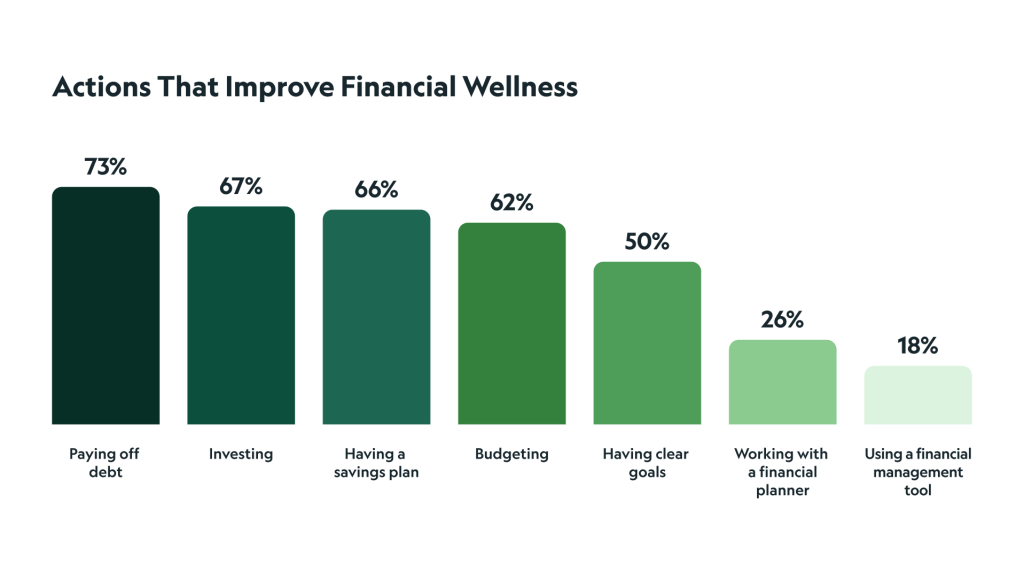

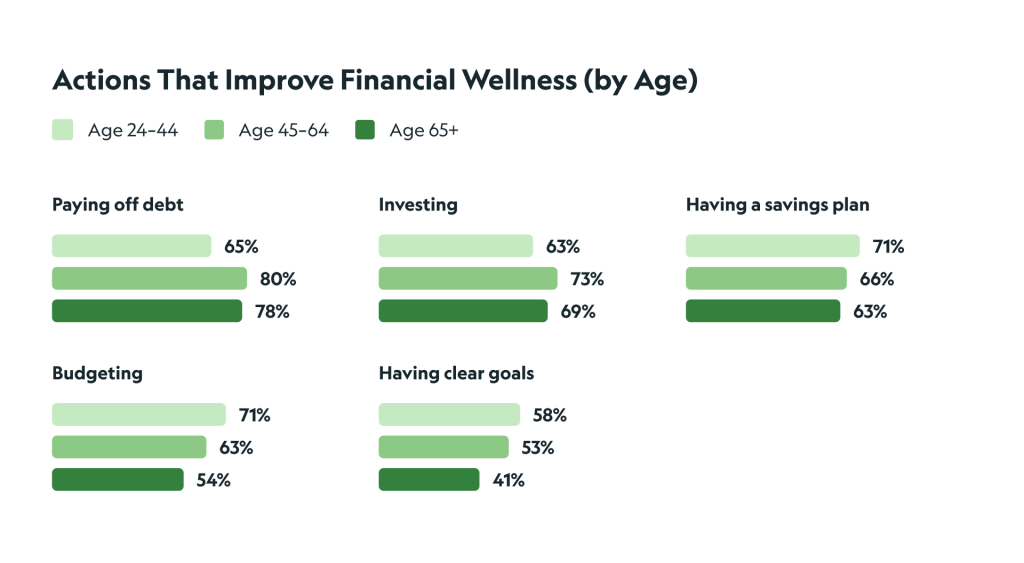

In addition to feeling proud about their money management, 1,317 survey respondents reported the actions they have taken that helped improve their financial wellness. The most frequent responses included paying off debt (73%), investing (67%), having a savings plan (66%), budgeting (62%), and having clear goals (50%).

One respondent, Larry M., says he’s achieved financial wellness by “borrowing only for essentials and never carrying a credit card balance.” Another, Mark F., says he achieves financial wellness by “always looking for the best and safest return for my money.”

Question: Which of the following, if any, have helped you improve your financial wellness?

Question: Which of the following, if any, have helped you improve your financial wellness?

Plans for Saving

Every respondent owns a high yield savings account, and many reported they are saving for specific goals. Some of the common responses included saving for retirement, building an emergency fund, home ownership, home improvements, medical expenses, and vacations.

One respondent, Janice D., is saving for a “comfortable retirement, grandchildren’s higher education, and vacation travel.” Another, Steve M., said he’s “trying to maximize my savings for emergency purposes, as well as for a new roof and other projects at my house.” Another respondent, Jess B., is saving to “move out to be on my own, specifically to an apartment in [a] city with a higher cost of living.”

Some respondents have less specific goals, such as saving for a sense of responsibility. Fernando M. said he’s “looking for any good opportunity” for his savings.

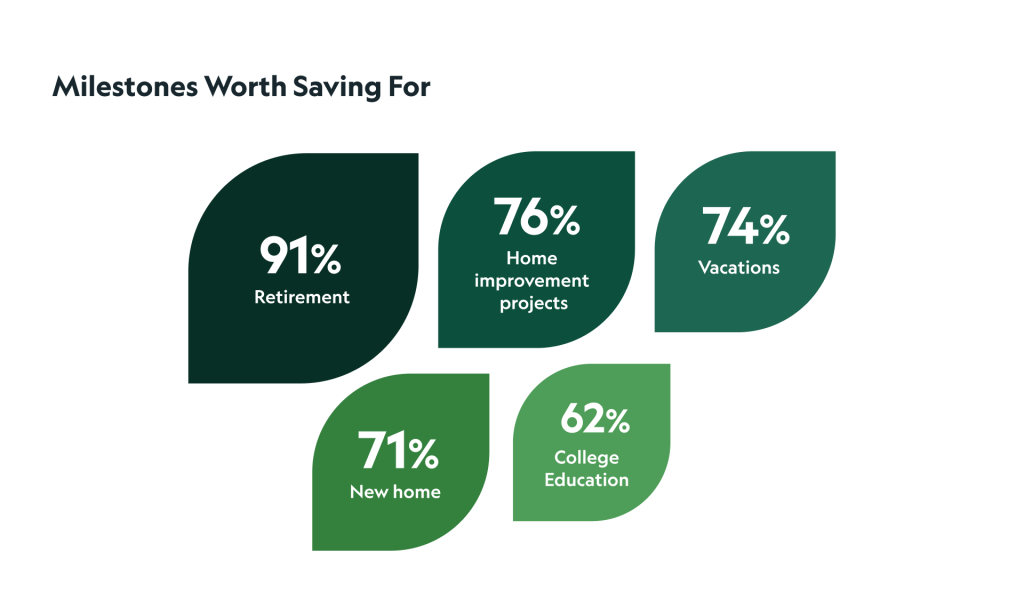

While each respondent has their own savings goals, many of them agree on the types of events that are worth saving for. Retirement ranks at the top of the list, as 91% of respondents somewhat or strongly agree that it is worth saving for. Other savings goals that ranked highly include home improvement projects (76%), vacations (74%), a new home (71%), and college education (62%).

Should a high-yield savings account be part of your retirement saving strategy?

Easy access to growing funds can serve several purposes in planning for retirement.

Saving for retirement is the most important goal for all generations of respondents. For Millennials, home ownership is a close second, with 83% somewhat or strongly agreeing that it’s worth saving for.

Question: How much do you agree or disagree that the above expenses are worth saving for?

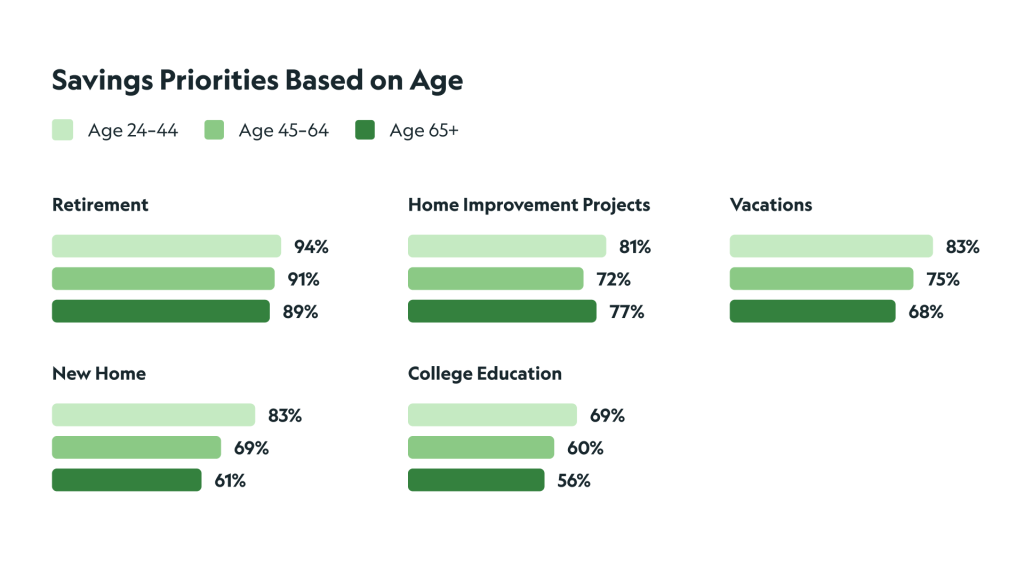

Despite age differences, respondents of all generational groups valued saving for similar milestones. The percentage of each generational group who agree that each milestone is worth saving for is below.

Question: How much do you agree or disagree that the above expenses are worth saving for?

Lifestyle Savings Habits

In general, survey respondents aim to save money when they can. They shared a number of strategies and habits they use to live a lifestyle of wise financial stewardship.

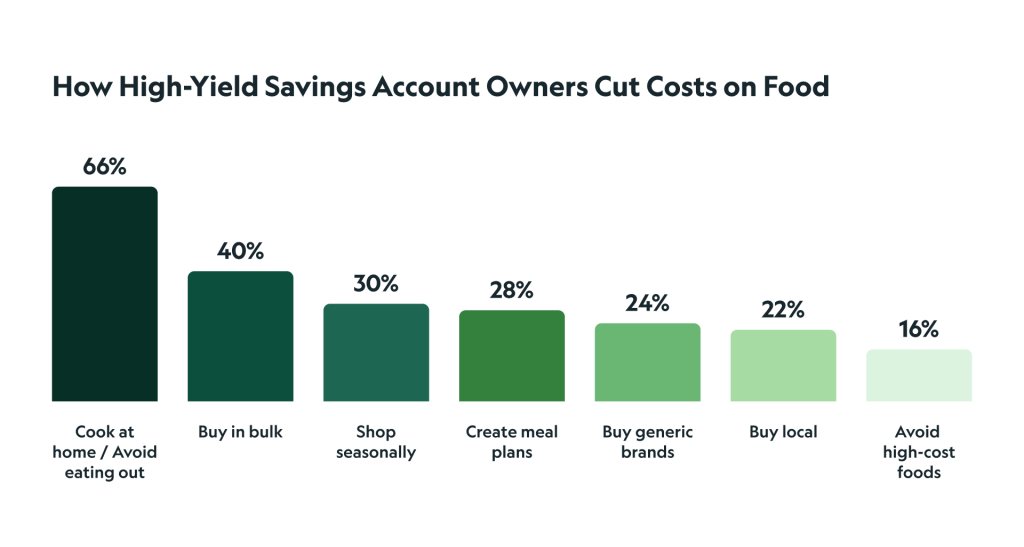

For example, 66% of respondents said they save on weekly food costs by avoiding eating out and cooking at home.

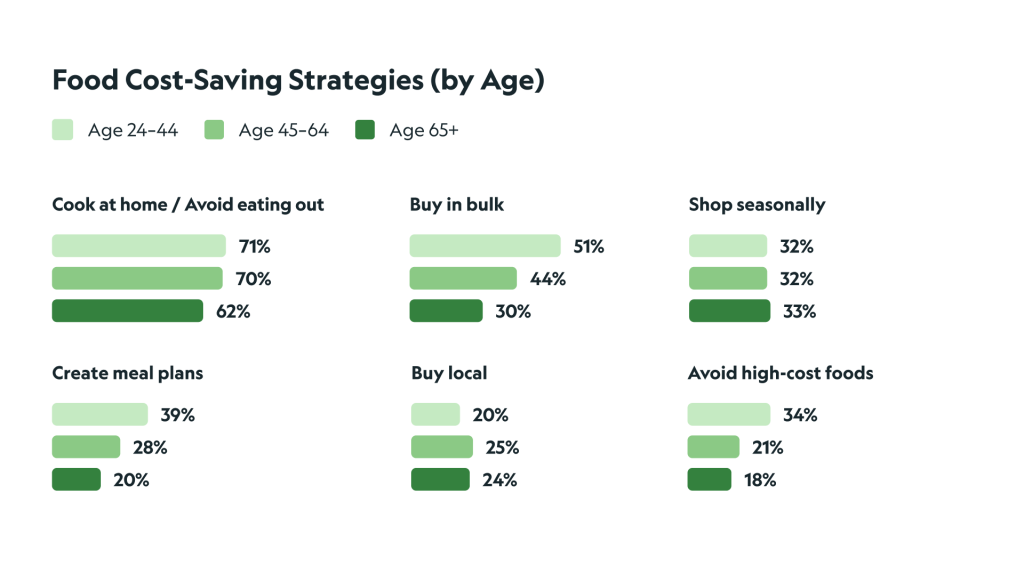

Respondents of all ages said they limit dining out and buy in bulk to save money on food costs. Younger respondents are more likely to focus on purchasing generic brands and creating meal plans to save, while older respondents are more likely to focus on shopping seasonally to save on food.

Question: How, if any, do you save or budget on weekly food costs?

Question: How, if any, do you save or budget on weekly food costs?

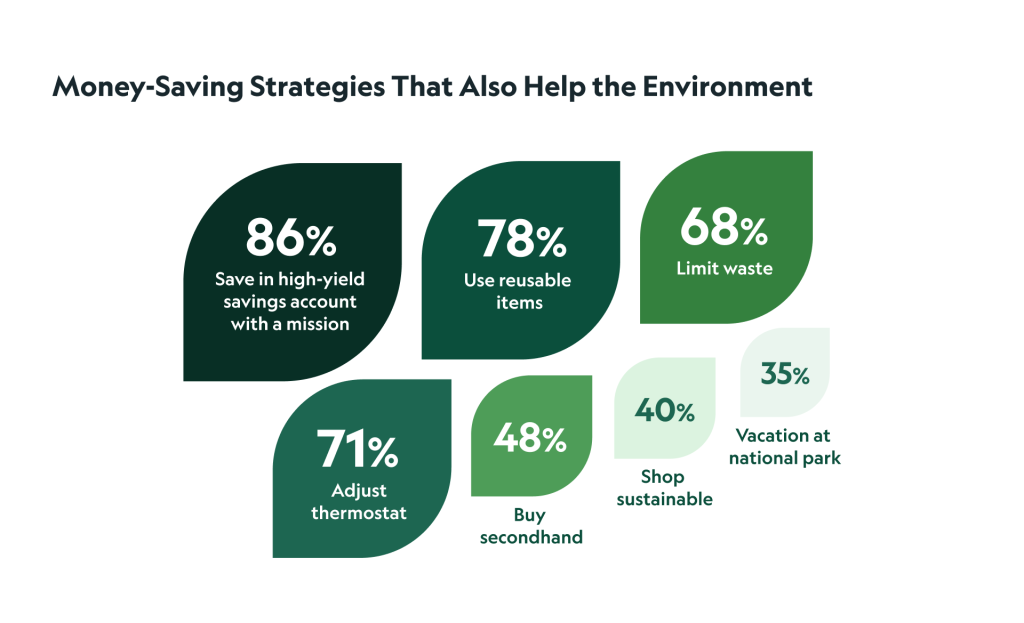

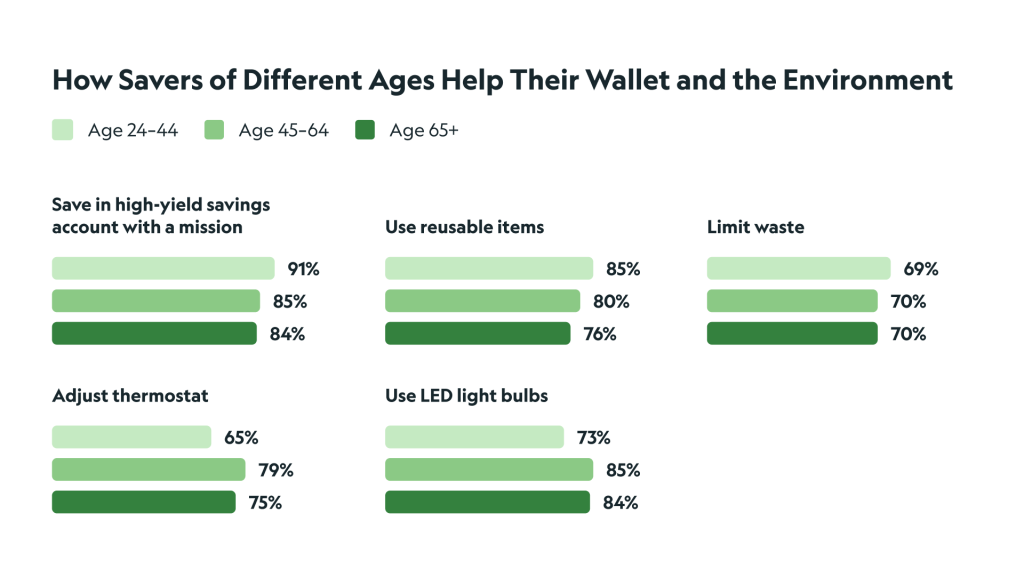

Many survey respondents share Forbright Bank’s commitment to building a brighter future. When asked which practices they participate in to help both their wallet and the environment, some of the most frequent responses included using reusable materials (78%), using LED light bulbs (78%), adjusting their thermostats (71%), and limiting waste (68%).

How can I save money and build a better world?

We recommend seven simple and convenient ways to save money and help the planet.

Some respondents shared other ways they personally aim to save money while helping the planet. For example, “I eat from my own backyard garden when it’s in season,” says Lynn M., and Michelle M. says she “switched to a heat pump and cycle[s] to work when the weather is decent.” Another respondent, Erica M., says she tries to “walk and take public transportation, fix and repurpose items rather than throwing away.”

Question: Which of the following practices, if any, do you take part in to help both your wallet and the environment? Select all that apply.

Question: Which of the following practices, if any, do you take part in to help both your wallet and the environment? Select all that apply.

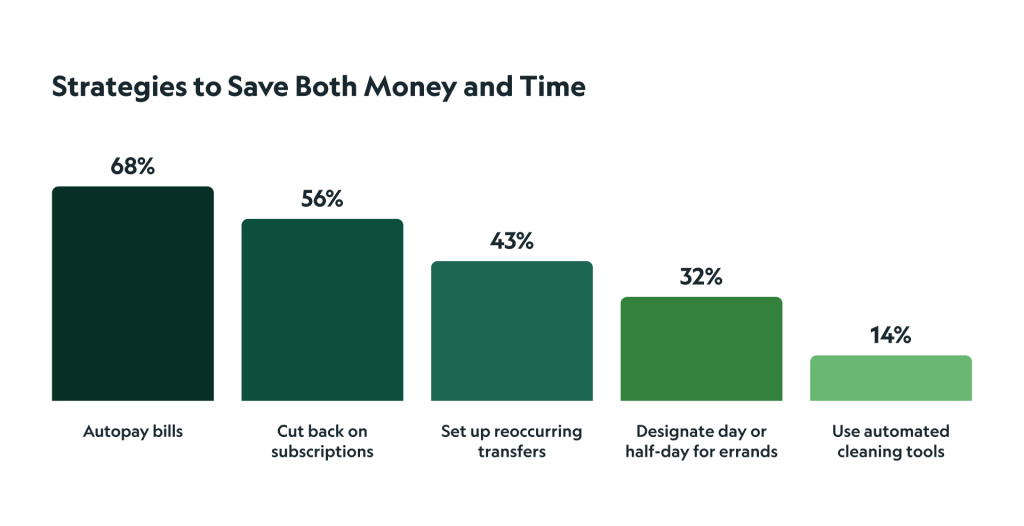

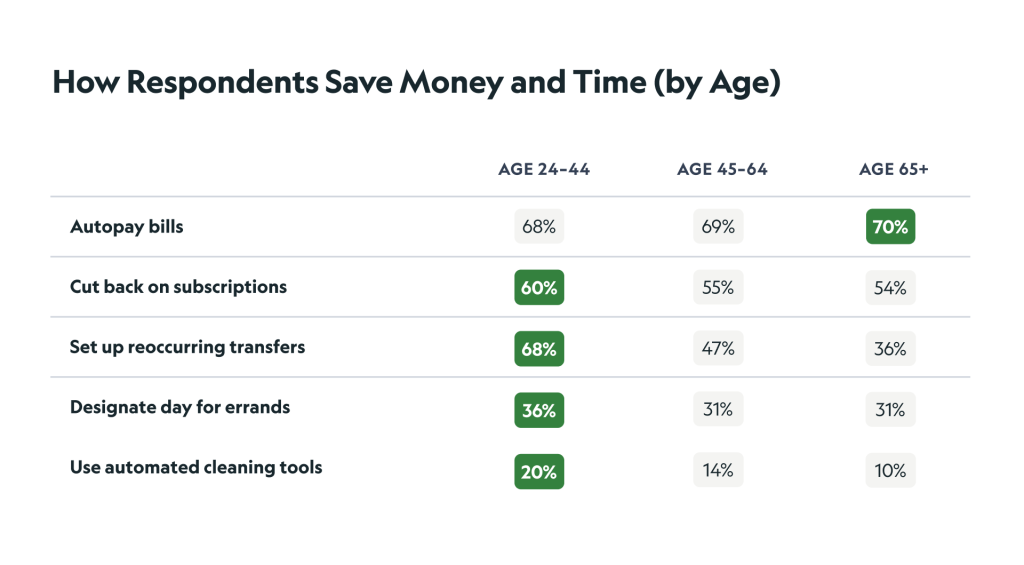

Respondents also shared the activities that have helped them save both money and time. Common practices for respondents of all generations include automation, such as autopay and recurring transfers, and cutting back on subscriptions. Almost seven in 10 (68%) report that they autopay bills to avoid late fees, 56% cut back on subscriptions, and 43% set up recurring transfers into their bank accounts.

“I direct deposit a portion of every paycheck to savings,” said respondent, Jenny T.

Question: Which of the following activities, if any, have helped you save money and given you time back in your days? Select all that apply.

Question: Which of the following activities, if any, have helped you save money and given you time back in your days? Select all that apply.

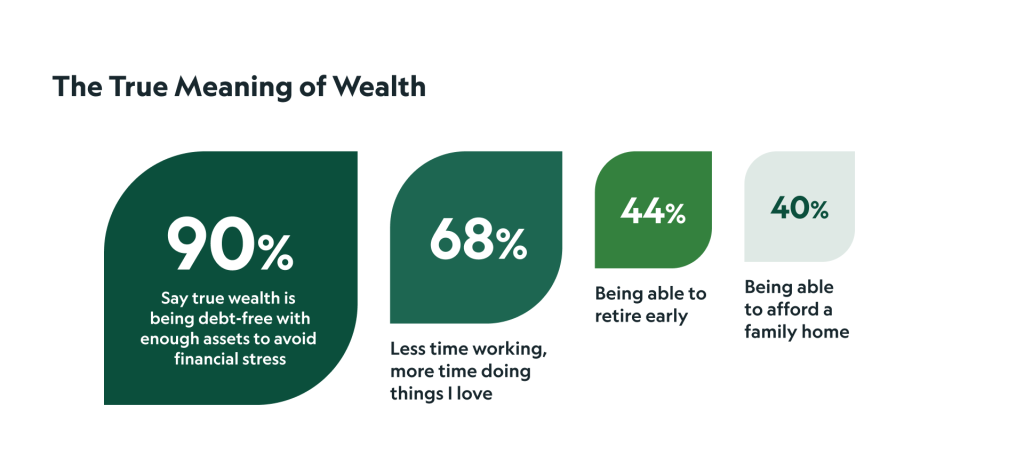

Respondents to the Growth Savings high-yield savings account customer survey broadly share a commitment to saving money and living a lifestyle that is unencumbered by financial worries. They also share an opinion that “wealth” can mean much more than simply accumulating more material things and is closely aligned with financial freedom rather than physical possessions.

What does it mean to be financially free?

Our customers equate “wealth” with financial freedom and recommend five steps to achieve it.

When asked what true wealth means to them, 90% of respondents selected “being debt free while owning enough assets to avoid financial stress.” Respondents could select multiple answers, and 68% selected “less time working and more time doing things I love.”

Question: What does true wealth mean to you? Select all that apply.

The survey results imply there may be a “chicken and egg” connection between owning a high-yield savings account: Financial confidence can come from seeing money grow in a high-yield savings account, and learning more about finances and the benefits of a high-yield savings account can drive the learner to open one. To learn more about Growth Savings or open an account, visit our Growth Savings page.

METHODOLOGY:

Forbright Bank’s 2025 Growth Savings Customer Survey was conducted for Forbright Bank by Qualtrics via email during March and April 2025. The survey was sent to Growth Savings customers via email, and 1,317 responses were received.